[Last weekly analysis]. This week the market sharply bounced back up. Both the daily and weekly charts look bullish. It is interesting to see if the next week will be another white candle.

Overview of World Markets and Sectors

On the weekly chart, the world markets appear be steady at the moment, however there is no decisive trend reversal yet. Emerging market, especially the mainland China market is gaining the strength compare with the developed countries.

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. SSEC looks very bullish.

Major indices, commodities, and US dollar are shown in the next chart. Nasdaq is bullish, so are the gold and US dollars.

Sector overview chart. Technology and health care sectors are the strongest, and financial remains the weakest.

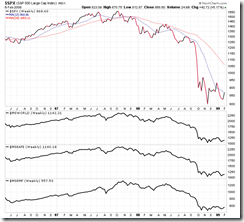

SPX

Two scenarios of wave unfolding.

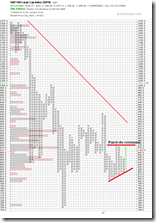

The market is going to test the resistance which can be seen on the following P&F chart:

On the hourly chart, SPX is overbought. Pullback target is 845. It can go higher before topping out.

XLF and SKF

The buy signal on SKF is not there yet.

Forex

USD/CAD: no update.

USD/SGD: in pullback.

EUR/USD: rebound is due.

Commodities

GOLD: watch the resistance and see if it can breakout.

Crude oil: no update