[Last weekly analysis] We have witnessed the most impressive four weeks of rally, which could be the biggest rally in the history at least since the bear market started in 2007. Although SPX has not reached the consolidation yet and big loss in the last four consecutive weeks is not fully covered, the upward momentum is extremely strong and this market condition is very usual also.

Overview of World Markets and Sectors

The trend is the same as the last week. No change to the original comments.

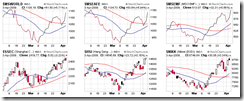

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. All markets look very bullish after a few days of pullback. MA-20 are all pointing up.

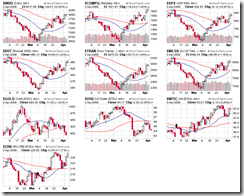

Major indices, commodities, and US dollar are shown in the next chart. Gold and US dollar are bearish, all other markets are extremely bullish.

Sector overview chart. All sectors are bullish especially technology sector.

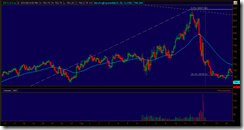

SPX

Wave counting is still the same. The right hand side is the target estimation.

Downside target for buying dip: 800-810, use MACD as a signal.

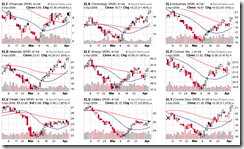

XLF and SKF

SKF is not a good buy before going back to 90. XLF is on the edge of breakout, although it’s overbought.

Currency Futures and Forex

US dollar index: the trend is still down after the rebound is over.

USD/SGD: at least one more down in the near term.

USD/CAD: down trend will continue.

EUR/USD: technical indicators are neutral. Assume the uptrend will continue.

Commodities

Crude oil: it has touched the support level and bounced back up. The trend is up, and the strategy is buy on dip!

Gold: long position should have been stopped out.

Direxion 3X ETF list.