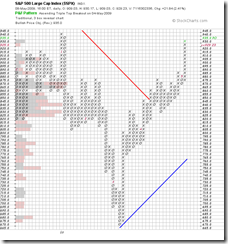

[Last weekly analysis.] In the past week the market broke the consolidation region at the upside. It opened at the low of week and closed at the high. SPX is now approaching 2009 high and has sit above EMA 34 decisively.

Overview of World Markets and Sectors

same as the last week.

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. The uptrend is truly amazing. There is no sign of weakening.

Major indices, commodities, and US dollar are shown in the next chart. Commodities are extremely bullish thanks to tanking dollar, Nasdaq is pulling back, transportation looks tired.

Sector overview chart. Almost the same as last week but technology is starting to pull back.

SPX/ES Wave counting

The first scenario presented last weekend turned out to be valid. The minor waves are adjusted and the extended wave 3 may have completed.

On the following P&F chart we can see that the breakout was confirmed and SPX is approaching the next target at 935. 875-885 is now a resistance.

XLF and SKF

The uncertainty in the financial sectors has gone, now XLF looks very bullish. From either internal structure or proportion’s point of view, the uptrend is not completed yet.

Currency Futures and Forex

no change no update.

Commodities

Crude oil: broke the overhead resistance, bullish. The uptrend may continue for a while.

Gold: no update

No comments:

Post a Comment