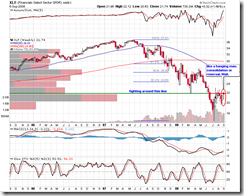

Take a look at the weekly chart first:

Now it is range bounding, and the previous trend is downward, so we cannot confirm it is bullish at the moment. The candlestick pattern of the past two weeks looks like a hanging man, which is a consolidation or bearish reversal. We need to wait for the confirmation. The chart also shows that bulls and bears are fighting around $22 line, and a decisive breakout above 22 or under 20 will be a clear signal to the next trend.

How is the long term trend then? Here is the P&F chart:

The chart shows that the first defense of bears is at 23. Breakout above 23 will corner bears to retreat to 26. Bears will be defeated once XLF closes above 26 decisively.

Now look at the daily chart:

Firstly, XLF is still bounded in a range between 20- and ~22.5. Next, note that the range between Fib 50% and Fib 61.8% is a previous consolidation zone. The volume within this region is quite heavy, so I expect XLF consolidates for an extended period. Closing above 23.7 will mean the trend is strong and the bearish trend has been reversed. We can also see a new trendline but it can be broken easily without any meaning. In my opinion, MA(50) seems like a support but it doesn't mean anything either, maybe it could provide some hope to bulls.

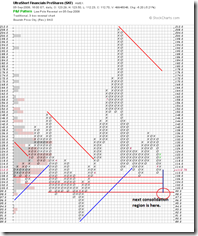

How is SKF -- the UltraShort Financials -- doing? Just take a look at a simple P&F chart:

Remember to disregard the price objective because I don't think it makes any sense. On the chart, 108 looks like a good support, but it has been broken during the after-hour trading. Then it may go straight down to 104 and 99. Depending on how XLF goes, the next reversal point will be likely between 97--99.

No comments:

Post a Comment