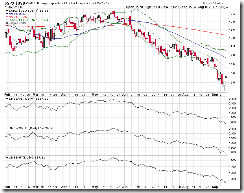

Market glance

Note that the whipsaw on XLF has disappeared. All mid-term trend signal is down.

SP500 is going up because US dollar is appreciating

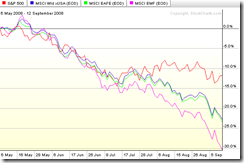

Here is weekly chart which compares the following four indices:

- $SPX:$USD: the US market;

- $MSEAFE: Europe, Australia, and Far East markets;

- $MSWORLD: the world market excluding US;

- $MSEMF: the emerging market.

After taking account into the appreciation of the US dollar, it is obvious the market was actually dropping instead of rising during the past few weeks.

Here is the daily chart:

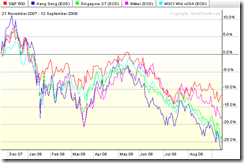

Here is the performance comparison during the past year:

and during the past 90 days (note that the markets all over the world seem being synchronized).

Comparison between US, Hong Kong, Singapore, Japanese markets, and the world average during the past 180 days.

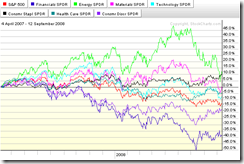

Comparison between different sectors in the US market

Conclusion:

During the good years, the money will flow to the emerging market. However the money will flow back to the US market during the bad times because the volatility of the US market is relatively small. When the bull market is coming, we should definitely invest in the emerging market. Wish respect to different sectors, it is difficult to say which one will survive the best but the energy sectors seems doing well in general, of course the entry point is critical.

No comments:

Post a Comment