[Last weekly analysis]. The gain of last week has been completely taken out by the red candle of this week. The chart is neutral since the it still looks like a range bounding.

Overview of World Markets and Sectors

On the weekly chart, as pointed out in the last week the worlds markets are quite steady, emerging market looks better than developed market which is a good sign.

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. SSEC looks bullish, and so is the emerging market.

Major indices, commodities, and US dollar are shown in the next chart. Nasdaq is still very strong with higher high and higher low. DJIA is in a descending channel. Since Russell 2000 and Wildshire 5000 are all range bounding, it's hard to claim that the market condition is improving, and in fact people are probably betting the techs could save the world. US dollar is unable to break the upper barrier, and the potential trend reversal could pump up the commodities which is lagging behind.

Sector overview chart. Note the weak sectors: financial, consumer staples, and industrials. On the other hand health care sector is strong which possibly means investors are seeking for safe territories for the fund, while it's interesting to see how long the technology sector can keep strong.

SPX

Firstly let's take a look at the futures. The sell off in the last several minutes put ES at maximum pullback target. If ES takes off at the current level, it can still break out Fib 50% area (marked as gray rectangle) and potentially go close to 850.

The scenario A proposed in the last week is more likely at the moment. No update to scenario B unless 873 on ES is decisively taken out.

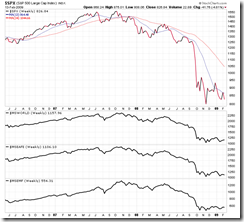

Last week, P&F chart clearly showed that SPX would test the resistance, and finally it fell down and formed a range bounding or double top pattern. Confirmation of breakout will take the index to November low, which is why the target price on the target is so discouraging.

On the hourly chart SPX is neutral, and 845-850 is still reachable at the upside.

XLF and SKF

SKF is neutral, no buy signal yet. No update this week.

Forex

US dollar: RSI is falling while the price is steady, this means the trend could reverse at any time. On the other hand, there could be a final rise up if the triangle pattern is resolved at the up side.

Euro: it's not a surprise that euro is at the opposite of US dollar.

Japanese Yen: the triangle can be resolved at either side, where the down side is a good news for the stock market.

Commodities

Gold: it broke out, let's see how severe the pull back is.

No update to the crude oil.