[Last weekly analysis]. This week the market tried to go back above 800 but finally dropped down. However, the market still gained 1.58%.

Overview of World Markets and Sectors

Over the intermediate term, the world markets are neutral to bullish while the emerging market leads all others.

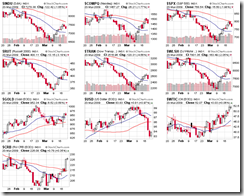

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. The pattern on the daily chart does not look good, we have to watch the follow-through on Monday to see if the trend really turns down.

Major indices, commodities, and US dollar are shown in the next chart. With the declining of dollar, commodities and crude oil continue to be bullish.

Sector overview chart. Based on the moving averages, financials and industrials are still two most bearish sectors.

SPX

Looking at the internal structure, I tend to think that the wave 4 of (5) is incomplete and wave 5 of (5) is still far away. Since the last week high didn’t overlap with wave 1, the bearish counting is still valid.

On the hourly chart, the first target at 750 seems nothing but a decent correction in the up trend. However 50% correction to 735 looks more reasonable. SPX 60-min system has given the confirmed sell signal. EMA50 on the ES hourly chart starts to fall, and the steep ascending channel doesn’t hold the trend any longer.

XLF and SKF

XLF has declined 38.2% from the top, and over the very short term it’s oversold so a small rebound is likely. However because of the strong volume during the pullback, further down is expected. SKF has resumed its uptrend.

Currency Futures and Forex

US dollar index: no sign of recovering, and this might be a good sign to the financials.

USD/SGD: wait for more declining after the consolidation

USD/CAD: up trend is broken, and it will fall down more.

EUR/USD: overbought, wait for 1.3-1.31 pullback and resume the uptrend.

Commodities

Crude oil: very bullish, buy on dip. Friday’s futures contracts rollover looks very much better than ever before.

Gold: bounced back off from the support, up trend still valid.

Charts from Cobra