ES/SPX wave counting: Today the market bounced up sharply from the Sunday night low and made a major accumulation day which cancelled previous major distribution day (refer to 0.0.1 Market Top/Bottom Watch). At the market close, ESM9 touched Fibonacci retracement 61.8% measured from 929.50 to 875.25. On the intraday chart, the market is overbought and due for a pullback. From waves’ perspective, there are two scenarios: (a) wave 4 of (C) finished last night and ES is heading to the final top near or higher than wave 3 at 929.50; (b) wave 5 and (C) finished at 929.50 and the market is going down in a zigzag way. The second counting is slightly more bearish, if this scenario turns out to be valid, the market may take a few days to consolidate before breaking down the last swing low. In the near term, the market may pull back a little bit.

Market breadth: the volume was better than last Friday but still quite weak for such a big move. TRIN was very low during the day, and TICK reading was very positive all day long accompanying with the strong up trend. CPCE on 2.8.0 CBOE Options Equity Put/Call Ratio shows that people become overly optimistic, while CPC seems also quite bullish. Note that NYADV on 2.4.2 NYSE - Issues Advancing has reached such a high level that only possible direction is down, which forecasts a pullback or consolidation day.

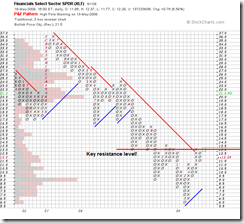

Financials: XLF gained 6.59% today on a declined volume. On the intraday chart, it is now overbought (refer to 5.3.1 Financials Select Sector SPDR (XLF 30 min)), and a pullback is expected. On the daily chart the pattern looks like a broken rising wedge. The downside support level is around 11.1~11.2, by taking out this level and MA20 on the daily chart, the intermediate term downtrend will be confirmed technically. Tomorrow it should not go further up significantly otherwise the broken rising wedge will be invalidated.

Currencies: on the daily chart, the downtrend of the US dollar was inversed last week and the near-term up trend is expected to last for a while, which is bearish to the stock market.

Crude oil: The consolidation between 56.5 and 60 has been lasted for a week, and there is no sign of upside breakout at the moment considering the uptrend of the US dollar. The weakening oil will be also bearish to the stock market.