Last weekly analysis. Most likely the intermediate term trend has reversed although this is unconfirmed at the moment. The market may consolidate for one more weekly, and a small rally should be possible. However the strategic direction is to short the broad market.

Overview of World Markets and Sectors

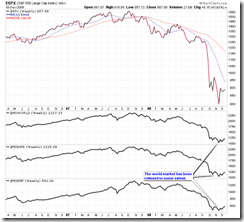

On the following chart US market looks weaker than the others which is not a good sign.

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. The direction is undecided.

Major indices, commodities, and US dollar are shown in the next chart. USD will likely dive down again in the near future, while the crude oil has no sign of recovery.

Sector overview chart. Only XLV and XLY are slightly better.

SPX

It is unclear to me whether the wave C of 4 is finished. Alternatively wave C might be just started and the market might have a new high as the following right chart.

P&F chart looks unchanged because no major support/resistance level is taken out. The reading on the hourly chart in the last week was correct. Now it looks more reasonable if SPX goes up to 880-890 in the next week before 860 is broken.

XLF and SKF

SKF has confirmed sell signal.

Forex

USD/CAD: it should have 10% space of drop down after the bounce is over.

USD/SGD: further rebound is expected.

USD/JPY: dropped from the watch list.

EUR/USD: it may drop down first before a new rally.

Commodities

Gold: it did take off in this week. The future seems bright.

Crude oil: the new support didn't work.

Matthew's charts

VIX long term chart: buy signal. The volatility is expected to drop down.

INDU - weekly long term: positive. bottom in place. buy.

Dow daily TRIX: still a buy signal however it could be over soon.

SPX LT Stochastics: bottomed out. buy.

S&P 500 Projection: wave 3 finished. Bottomed out.

SPX daily TRIX: same as INDU.

NASI 1 year: buy signal.

$CRX - Commoditiy Related Equity Index: almost a buy signal.

SSO system: buy.

SDS system: short.

Index All: short term down.

USD monthly: down.