This is the update to the last weekly analysis.

SPX daily:

Same chart and same outlook as the last week. But I expect the SPX touches 1280 first.

SPX 60-min chart:

Short-term bullish. 1240 is the next target.

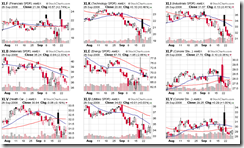

XLF daily:

Keep an eye on how it goes after Oct 2nd. The turning point of SPX/XLF will be around Oct 3rd.

XLF 60-min:

Short-term bullish. Buy UYG on the dip. Avoid SKF at the moment.

QQQQ daily:

Mid-term bearish. But this leg could be zigzagged and take some time to finish.

QQQQ 60-min:

Short-term bullish. The next target is 44.

RUT daily:

Just a wild guess. Short-term bullish, mid-term bearish.

-------

SSCC 60-min:

TAN 60-min:

-----

The discrepancy between LIBOR and short term treasury bill is still very high, actually it's higher than yesterday. Those banks are not trusting in each other, and this is a warning to the market internals.

INDU leads the broad market. $COMPQ and $RUT are quite weak. Transportation hit a new low. Commodities is in correction but it looks like a bull flag. US dollar is supported by MA50.

Bullish percent of major markets:

-----------

Regional banks are bullish:

Retail-Apparel looks good:

------

SPX descending channel:

XLF new ascending channel:

QQQQ channels:

No comments:

Post a Comment