大盘连跌3天,按照过去的惯例,周一或周二应该回调。

上午由资金买入,但盘尾抛盘严重,这是比较可疑的。不过这个不是信号。

002:上升三角形和rising wedge都已经破了,近期严重不看好。至少rising wedge可能变成上升通道,目标是80-85之间。

STO超买已经解除。NYMO仍然超买。

003:中期信号没有变。不过这个是滞后的。

103: 趋势线破了,但STO到了要了要反弹的位置。

200: VIX上的RSI2严重超卖,要反弹,刺破ENV20,问题很严重。(青蛙本人不很看中VIX分析)

因此,可以短期做空了。今天可以留空仓,或者周一涨了再空。

Here is the last weekly analysis. The market tested the short-term top again and retreated. If this is a sign of weakening the early warning of trend reversal, we have to watch carefully.

Overview of World Markets and Sectors

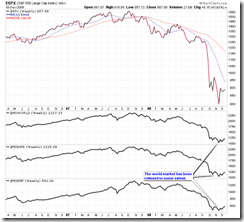

Very like the world market has formed an intermediate term bottom and all markets are trying to go up however no one has really taken off yet.

Comparison between US market and Asian markets: lower high and higher low everywhere. A breakout is due.

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index.

Major indices, commodities, and US dollar are shown in the next chart. The crude oil is weakening continuously, and the US dollar is bouncing back, commodities don't look so good. The directions of all major indices are undecided.

Sector overview chart.

SPX

The reading in the last weekend was correct. Now it's hard to say whether the wave C of 4 is finished or not. Most likely not, then the market has to rally substantially on Monday.

P&F chart shows the same thing as the last week. On the 60-min chart, it looks like the correction is not over yet, and further down to 870 is more reasonable before a new wave of rally. By the way, the analysis in the last week was correct: faked breakout happened and no 950.

XLF and SKF

XLF: P&F chart looks very similar to the last week, one can see that 13.0 is indeed a good short.

SKF: the timing is a little bit early, but now the long signal has been confirmed.

Forex

USD/CAD: target was 1.15 and the last low was 1.18.

USD/SGD: strong rebound.

USD/JPY: nice pattern but it is no longer that important after the Fed target rate is approaching zero.

EUR/USD: the target was over-reached. Now it's going back to normal.

Commodities

Gold (continuous adjusted): Here is the monthly chart of gold price since 1974. It's above a key support/resistance level. After the retesting, I think it should take off after some time.

Crude oil (continuous adjusted)

The following chart [left] shows the adjusted crude oil price since 1983. Let's see if the new support level will work.

Matthew's charts

VIX long term chart: buy signal.

INDU - weekly long term: positive. bottom in place. buy.

Dow daily TRIX: buy signal.

SPX LT Stochastics: bottomed out. buy.

S&P 500 Projection: wave 3 finished. Bottomed out.

SPX daily TRIX: buy signal.

NASI 1 year: buy signal.

$CRX - Commoditiy Related Equity Index: buy signal looks like coming?

SSO system: buy.

SDS system: short.

Index All: short term down.

USD monthly: down.

Miscellaneous

Here is the 1-min chart at the market close. ES was almost stabilized at 886 but pushed to a very low by a huge volume. Look at it more carefully, the big short order at the market open was not stupid.

So was YM. And SPY.

Here is INDU 60-min, neutral to bearish. INDU 15-min, should have one more push up.

2 comments:

Thanks a lot!

You are becoming awesome day by day!

purety, thanks for reading my blog. :-)

Post a Comment