收盘小结

OE大盘基本收在850,算有了follow-through。但今天的焦点应该是金融。板块波澜起伏,个股惊涛骇浪。XLF虽然只跌了3%,但看C, JPM, BAC都是险象环生,个个都摆出清仓大甩卖的架势。OE市场操纵的后果可以从SKF上看出来,收盘价相对intrinsic value低了大约10元的样子。

二月份原油期货该roll over的应该已经差不多了,成交量不是很大,波动仍然不小,是一个大喇叭状的图形。究竟这喇叭要喊什么话,下星期等二月份的都过期了就知道了。

黄金期货全天上涨4.39%。美元还没有开始动,但估计应该不会等太久。这个对大盘是个好消息,至少面子上要涨一下的。

T-bond/T-note稍有下跌,没有太大的起伏。

/ES夜里测试了前天的高点,随后下滑到826.25左右,之后一路上涨。收盘比较平静,没有太多的悬念。XLF看收盘也差不多,卖方稍微占优,早上有一个巨大的卖单。

从SPX的小时图上看,现在有了higher low,还没有higher high,MACD是买入信号,RSI中性。

蛇老大的图:

0.0.2 SPY Short-term Trading Signals: SPY收了黑棒棒,有心的应该记得蛇老大以前怎么说的,RSI/STO支持短期买入,成交量萎缩,算是price up volume down,RHNYA下跌,所以综合考虑是中性偏熊(价格牛一些,breadth熊一些)

0.0.3 SPX Intermediate-term Trading Signals:SPX成交量上升,和SPY有区别,我认为指数比ETF要准一些。BPSPX和MACD都是卖出信号,NYSI尚未确认,也差不多了。这个图没有任何牛的地方。

1.0.3 S&P 500 SPDRs (SPY 30 min):RSI/STO信号中性,MACD买入信号,注意看缺口和红色的阻力支撑线。

1.0.4 S&P 500 SPDRs (SPY 15 min):所有信号中性。注意SPY突破缺口之后必须勇往直前,否则成了rising wedge就不好看了。

2.0.0 Volatility Index (Daily):VIX下跌回落到支撑线上。

2.4.2 NYSE - Issues Advancing:不要忘记,下面还有一跌。

5.3.0 Financials Select Sector SPDR (XLF Daily):短期严重超卖,有反弹需求。从图形上看现在在下降通道外面。MACD卖出信号。

综合起来,我的建议是:SKF继续持有,不要加仓,是否锁定利润自己看着办,拿到现在已经没有任何风险了,可以赌个大的了。大盘可能短期反弹,现在加仓还不是时候,要观望;中期看跌,不建议抄底,除非空仓太多,想对冲短期反弹的风险。

Here is the last weekly analysis. This week the intermediate term down trend was confirmed, and the market sold off sharply. In the last two days the market started to bounce back up, however it will not last for too long.

Overview of World Markets and Sectors

Again, US market leads the world. As expected in the last week, other parts of the world are following the US market and going south, which isn't a surprise. At the moment, the emerging market still shows larger volatility and better strength. What we could do is to use EEV (UltraShort MSCI Emerging Markets) to take advantage of the down trend, and this ETF has risen 12.83% in the past week and outperforms SDS (9.44%).

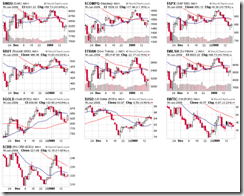

The next chart shows the MSCI World/EAFE/Emerging Market, Shanghai Stock Exchange Composite Index, Hang Seng Index, and Nikkei 225 index. The mainland China market doesn't follow US, while Hang Kong and Japan are sinking.

Major indices, commodities, and US dollar are shown in the next chart.

Sector overview chart. Now one can see that shorting financials is a good trade. If one needs to hedge the short positions on financials, energy sector could be a good candidate.

SPX

Now it seems several different ways of wave counting can happen. For scenario (A), the market could go up to 900+ and form a giant triangle and then start the wave 5 down. In scenario (B), wave 5 has started, and the short term rally should not go above 900. In scenario (C) the wave 4 is not finished yet, then SPX could make a new high! Most likely the next turning point will tell us which scenario is real.

On the P&F chart, we can see SPX precisely reached the resistance at 820 and headed up. Now it's approaching an important level at 860. Nothing can be predicted but once SPX dives down again to 820, the support will be likely broken and new low could be reached.

The scenario proposed in the last week on the hourly chart was invalidated after SPX went below 880. This weekend, considering the short term bottom has been in place, I estimate the upside target is 875-880 in the near term. This will be corresponding to the scenario (B) of the wave counting.

XLF and SKF

There was no struggling at all, XLF jumped off the cliff as expected in the last week. Surprisingly SKF didn't fly very high considering UYG was selling off hardly. One can see a positive divergence on RSI however it is absolutely not a reason to buy in. I expect a rebound caused by the extremely oversold and short covering after one more selling off.

Needless to say, SKF took off and disseminated some money to people who stuck on it. The daily chart starts to be overbought, but the trend still looks promising. On the hourly chart, the sell signal has been confirmed. If it opens high on Tuesday, it will be prudent to take the profit off the table immediately.

Lastly take a look at those individual stocks in the financial sectors. See how terrible they are, unless you really know what is going on in the financial system DO NOT LONG any of them no matter how cheap they look. Individual stocks are dangerous in the bear market, and financials are even more so. No point to catch the falling knife and commit suicide later when they get cheaper and cheaper.

Forex

USD/CAD: it bounced back up in the past week. It could be caused by the crude oil.

USD/SGD: it still has some upside room.

EUR/USD: let's see if it bounces back up from the support level.

Commodities

I have decided to update the long term trend every month since it doesn't change too much each weak.

Gold: the observation in the last week is correct but it has gone back to the ascending channel. We need to see if there is a follow through.

Crude oil: during the last two trading days people were rushing to roll over the Feb contracts to the next month.

Matthew's charts

VIX long term chart: signal reversed, it's time to short the market.

INDU - weekly long term: positive. bottom in place. buy.

Dow daily TRIX: reversed to sell signal.

SPX LT Stochastics: bottomed out. buy.

S&P 500 Projection: wave 3 finished. Bottomed out.

SPX daily TRIX: same as INDU.

NASI 1 year: sell signal confirmed.

$CRX - Commoditiy Related Equity Index: buy signal has been confirmed.

SSO system: sell.

SDS system: buy.

put,call and put,call 10 day: no bottom yet.

2 comments:

Yager, I cannot acess Hutong since 01/19 3:30pm from home and working place. I am in Canada. I do not know what happen.

If you can enter Hutong as usual, please let me know from here, my Hutong I.D. is QSCNC, is your friend.

Thanks

Anyway, cobra help me solve already from his blog.

Thanks

Post a Comment